Personal Loan With MobiCred

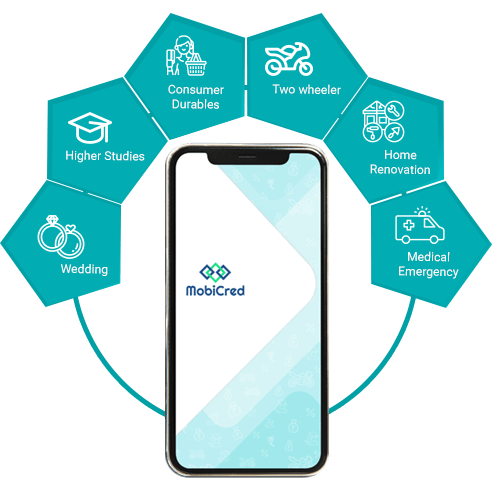

What is a MobiCred Personal Loan

Bangalore," the silicon valley of India" has one more smart mobile loan app Mobicred for instant personal loan.

A personal loan is an arrangement of borrowing cash for meeting emergency financial needs. It is often known as unsecured loan as no other collateral security is insisted upon. Here only personal guarantee and commitment of the primary borrower is insisted

upon. The money is disbursed to customer's bank account in the form of a loan.

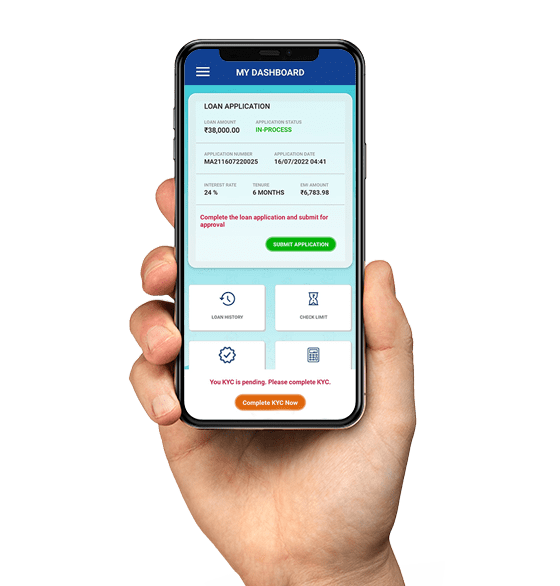

MobiCred is an easy to use digital lending solution provider which enables customer to apply and avail personal loans from the comfort of their home. It is a secured mobile app of Oricred Finserv Pvt Ltd, a registered NBFC. Loan

gets sanctioned promptly after upload of all necessary documents. Entire process from loan application, verification, approval, completion of documentation and disbursement is totally digital, fast and contactless. Customers

have to register their details in the app, upload the necessary KYC and other documents required for the loan approval process. Once approved, the money is transferred to the customer's bank account.